Smart Summer Hustles: How Teens Can Earn, Save & Build Financial Confidence

School’s out, and summer is the perfect time for teens to earn their first paycheck. Whether it’s scooping ice cream, lifeguarding, or launching a side hustle, a summer job isn’t just about cash—it’s a launchpad for financial independence. Opening a savings account and learning how to manage money early.

Looking for ideas? Here are some popular (and flexible!) ways teens are earning this summer:

- Retail Crew: Clothing stores, grocery chains, and local shops often hire seasonal help.

- Lifeguard or Swim Instructor: Great for strong swimmers with certification.

- Babysitting or Pet Sitting: Flexible hours and perfect for those who love kids or animals.

- Yard Work & Landscaping: Mowing lawns, weeding, or planting for neighbors.

- Camp Counselor: Fun, social, and ideal for those who enjoy working with kids.

- Freelance Gigs: Tech-savvy teens can offer tutoring, content creation, or graphic design online.

Tip: Encourage teens to explore their interests, turning a hobby into a job can make work feel like play.

Why a Teen Savings Account Is a Game-Changer

Opening a savings account early helps teens build real-world money skills. Here’s why it matters:

- Money Management 101: Watching your balance grow and tracking spending builds responsibility.

- Earn While You Save: Even small deposits can grow thanks to compound interest.

- Banking Confidence: Learning how to use financial tools now sets teens up for success later.

The Power of Saving Young

Starting early gives teens a serious edge:

- Compound Interest = Magic: The earlier you save, the more your money grows.

- Habits That Stick: Saving now makes budgeting and planning second nature later.

- Freedom & Flexibility: Whether it’s a new laptop, a car, or college savings—having money saved means more choices.

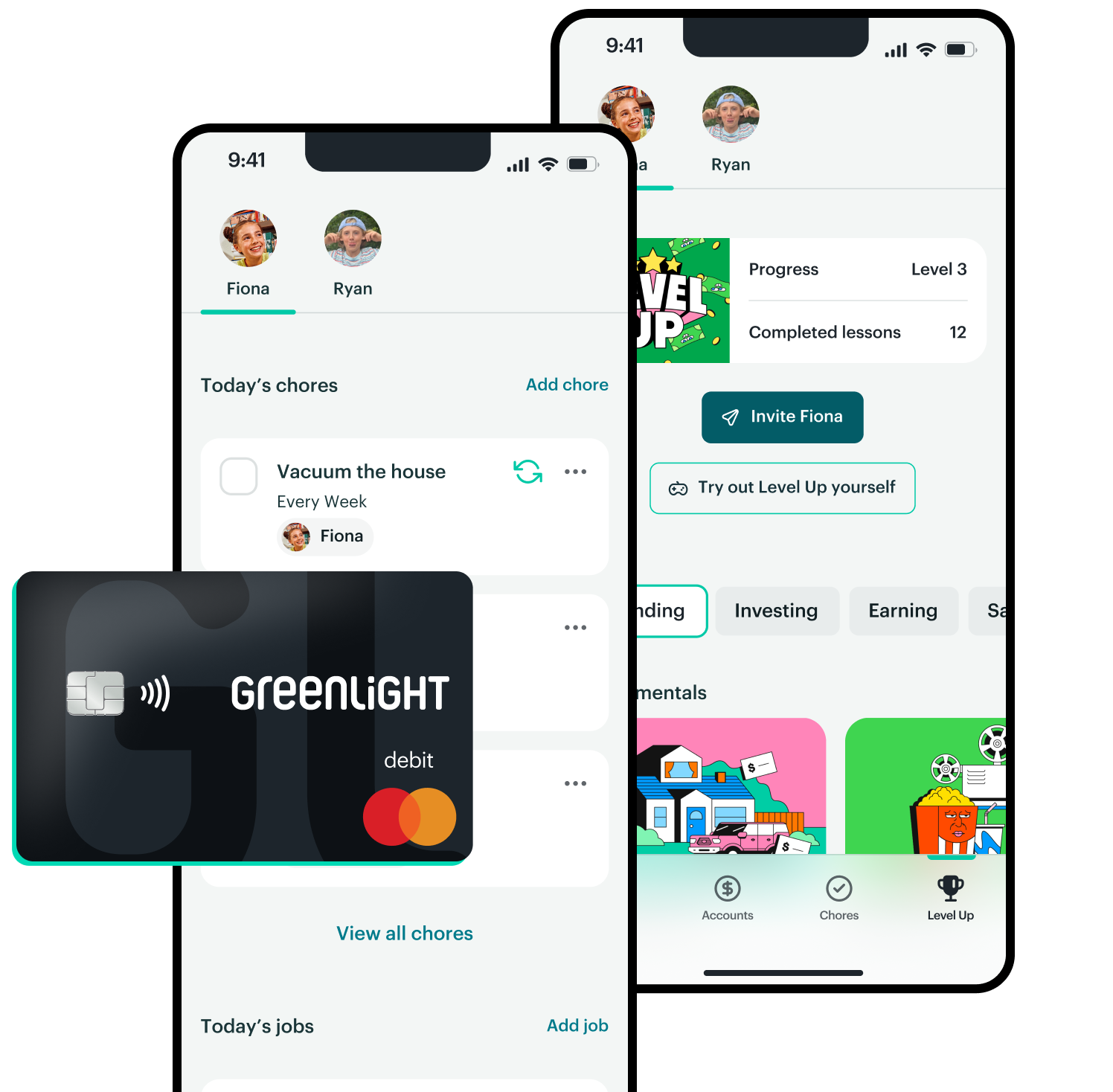

Mobile Banking Application: For the entire family.

Build money skills while school’s out. Greenlight teaches kids and teens to earn, save, and spend wisely with a debit card1, money app, and financial literacy game. It is complimentary2 for The Atlantic families!

1The Greenlight card is issued by Community Federal Savings Bank, member FDIC, pursuant to license by Mastercard International. Card images shown are illustrative and may vary from the card you receive.

2The Atlantic Federal Credit Union Members are eligible for the Greenlight SELECT plan at no cost when they connect their The Atlantic Federal Credit Union account as the Greenlight funding source for the entirety of the promotion. Subject to minimum balance requirements and identity verification. Upgrades will result in additional fees. Upon termination of promotion, Members will be responsible for associated monthly fees. See terms for details. Offer ends 07/03/2026. Offer subject to change and partner participation.